Ii the supplementary income tax that is development tax. A tax credit for foreign income taxes paid abroad by Korean residents up to a limit of the amount of Korean income taxes before the foreign tax credit times the ratio of foreign source income to worldwide total taxable income.

With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses.

. The sole purpose of a synthesised text of the MLI and a bilateral tax treaty is. Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to the Malaysian IRB within one month of paying or crediting. A tax resident is entitled to claim foreign tax credits against Malaysian tax.

Any excess over the maximum allowable credit may be carried forward for five years. The 1996 UK-South Korea Double Taxation Convention has been modified by the Multilateral Instrument MLI. The tax agreement is applicable to the tax residents of a country who obtain taxable incomes in the other contracting state and it refers to a set of specific taxes as mentioned by the Article 2 of the treaty which stipulates that both countries are required to apply similar taxes depending on the national tax law of each state.

A The tax treaty between Norway and Yugoslavia of 1 September 1983 is suspended. AGREEMENT BETWEEN THE GOVERNMENT OF MALAYSIA AND THEGOVERNMENT OF THE REPUBLIC OF AUSTRIA FOR THE AVOIDANCE OFDOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITHRESPECT TO TAXES ON INCOME. The Cambodia-Malaysia income tax treatysimilar to income tax treaties with other neighboring Southeast Asian countriesincludes reduced rates of withholding tax for various payments such as dividends royalties technical services and interest.

By the exchange of notes 6 March 1997 the treaty was given effect for Slovenia as from the date of independence of the Republic of Slovenia until January 1 2009. South Korea - Malaysia Tax Treaty. Foreign tax relief.

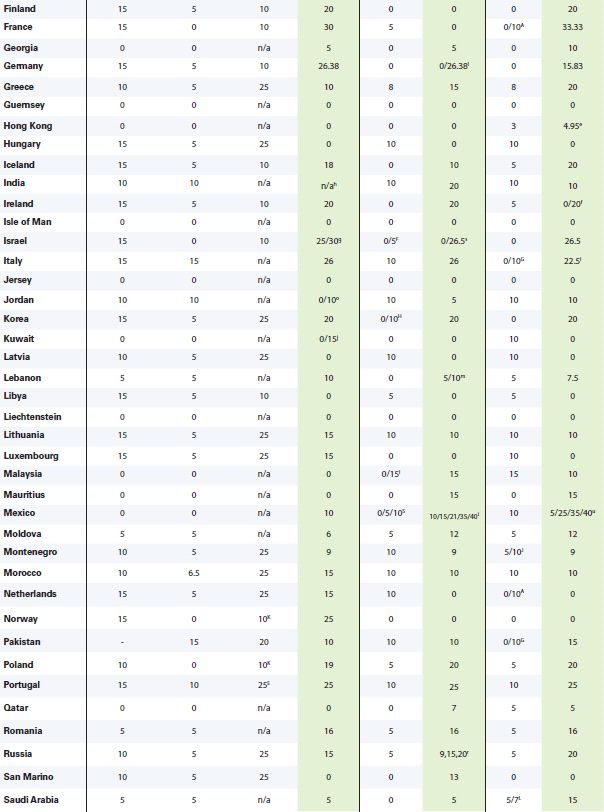

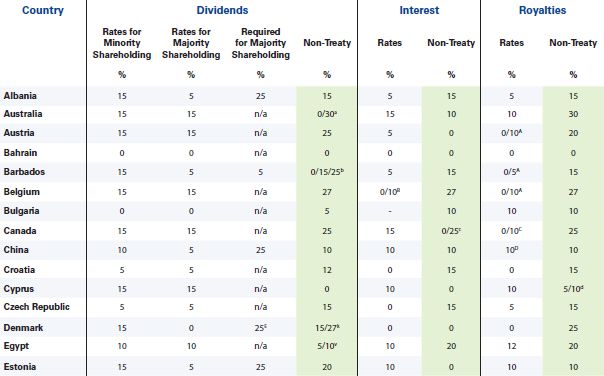

Please refer to the actual DTT or your tax advisor for further information. An additional residents surtax of 10 is imposed resulting in an effective withholding tax rate of 22. For dividends interest and royalties the WHT rates are limited as follows.

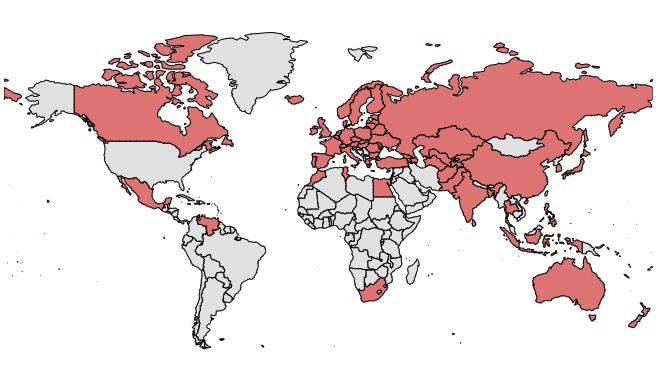

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Our firm also maintains client liaison offices in the United Kingdom United States Italy Russia and Germany. The following countries have concluded double tax treaties with Malaysia.

Or ii sections 21 22 26 30KA and 30Q of the Investment Incentive Act 1968 of Malaysia so far as they were in force on the date of signature of this Agreement. I the income tax on foreign legal persons. The contract payments are services provided in Malaysia and are subject to a 10 withholding tax rate.

International Tax Agreements Amendment Bil No. The withholding tax is mentioned by the treaties signed by Malaysia with countries worldwide and it applies to interests and royalties while dividends are exempt. Yes Americans are obligated to pay US.

Hereinafter referred to as Malaysian tax. The complete texts of the following tax treaty documents are available in Adobe PDF format. The Double Taxation Agreement entered into force on 8 July 1998 and was amended by a protocol signed on 22 September 2009.

UU Harmonisasi Peraturan Perpajakan. Klaster Kemudahan Berusaha Bidang Perpajakan. B in the Union of Soviet Socialist Republics.

Taking foreign income into account. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. Where a treaty exists the credit available is the whole of the foreign tax paid or the Malaysian tax levied whichever is lower.

Foreign tax relief. I sections 54A 54B 60A 60B and Schedule 7A of the Income Tax Act 1968 of Malaysia. Dezan Shira Associates has grown to support 28 offices throughout China Hong Kong SAR India Singapore and Vietnam as well as our 8 Asian Alliance partners in Bangladesh Indonesia Malaysia The Philippines and Thailand.

The United States is one of only two. The Government of the Republic of Korea and the Government of. If a beneficiary cannot be identified in the application form the withholding agents should withhold the tax at the non-treaty rate.

20 September 1989 ViennaEffective Date. VAT on Electronic Services. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

Dividends Tax refund. For residents of countries having a tax treaty with Korea reduced WHT rates may apply. Ii the income tax on population.

The Government of Malaysia and the. INCOME TAX ACT 1967 AND PETROLEUM INCOME TAX ACT 1967 DOUBLE TAXATION RELIEF KOREA ORDER 1982. Tax Audit Guide Book.

I the income tax and excess profit tax. 20 April 1982 1 January1983 Effective. The income tax treaty with Malaysia is the eighth treaty in Cambodias network of income tax treaties.

IN exercise of the powers conferred by subsection 1 of section 132 of the Income Tax Act 1967 and subsection 1 of section 65A of. And iii the petroleum income tax. By the exchange of notes the treaty has been given effect for Croatia as from 6 March 1996.

In the case of royalties the withholding tax is set at 10 while for interests is a 15 rate. In the absence of a tax treaty the credit available is restricted to half of the foreign tax paid. Agreement between the Government of the Republic of Korea and the Government of Malaysia for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income Signed at Kuala Lumpur April 20 1982 Entered into force January 2 1983.

The modifications made by the MLI are effective in respect of the 1996 UK-South Korea. 1 January 1999 for taxes. Up to 10 cash back Tax Accounting.

By the exchange of. Kerja Sama dan Kemitraan. Income Tax International Agreements Amendment Bill 1983.

DTA MALAYSIA - KOREA. The agreement is effective in Malaysia from. Main taxes under the Malaysia-Korea DTA.

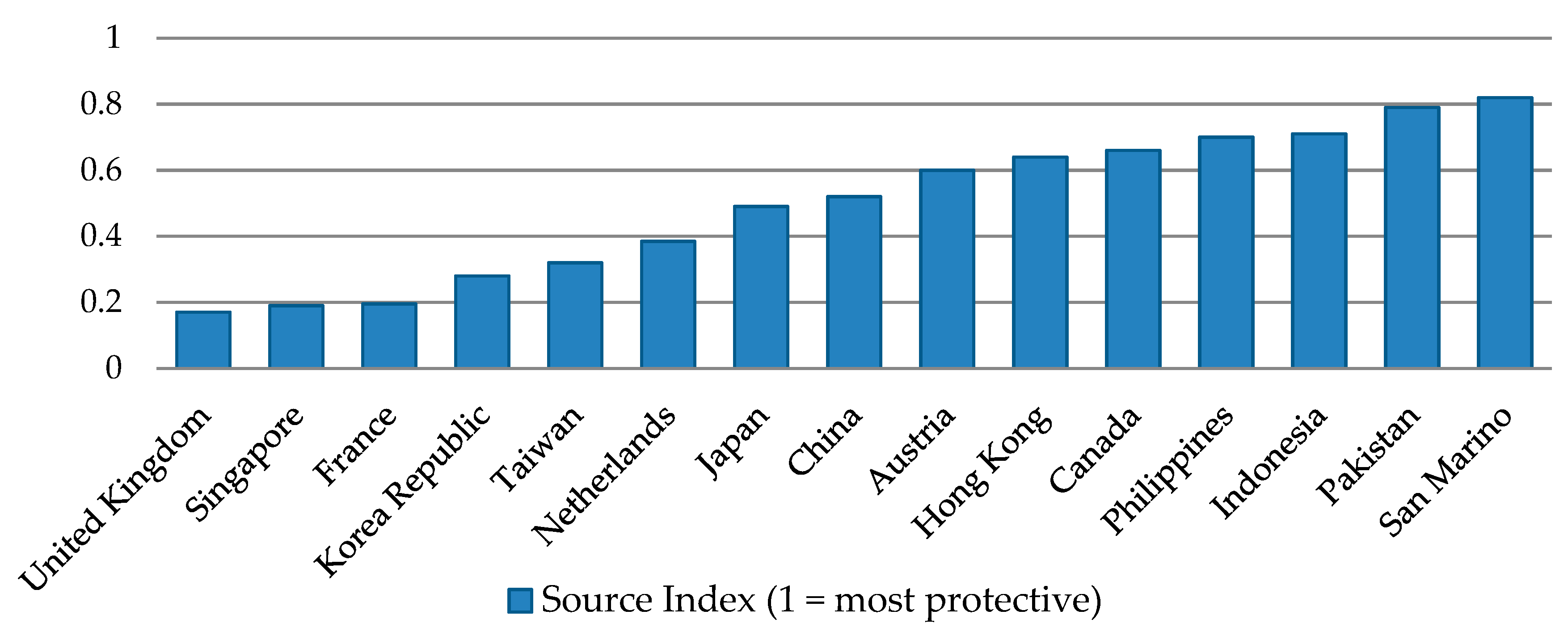

The standard rate of withholding tax on income from South Korean equities is 20 before any refund. By the DTT -. Korea Republic of DTA.

Korea - Tax Treaty Documents.

Countries With Double Taxation Treaties With Pakistan Download Table

The Treaties Explorer New Data For Better Negotiation

Lesotho Thailand And Viet Nam Sign Landmark Agreement To Strengthen Their Tax Treaties Oecd

Major Step Forward In International Tax Co Operation As Additional Countries Sign Landmark Agreement To Strengthen Tax Treaties Oecd

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Form 8833 Tax Treaties Understanding Your Us Tax Return

Malta S Double Tax Treaties January 2016 Withholding Tax Malta

Tax Treaties And Exempt Income Withholding Tax Worldwide

Double Tax Treaties Experts For Expats

Malta S Double Tax Treaties January 2016 Withholding Tax Malta

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Spain Tax Treaty International Tax Treaties Compliance Freeman Law

Is There A Tax Treaty Between Canada And South Korea Ictsd Org

France Denmark Double Tax Treaty Finally Signed By Both Countries

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

Understanding Tax Treaties And Totalization Agreements

Bahrain Signs Landmark Agreement To Strengthen Its Tax Treaties Oecd